Where do we start when it comes to explaining Australia’s tampon tax?

Well, first of all, women have been paying tax for their “luxury” sanitary items for too long. The tampon tax is not just another compulsory form of GST we (only women) have to pay – it is a continual source of gender inequality in Australia highlighting just how far we still have to go.

The Australian Women’s Weekly, Woman’s Day and Good Health, along with ELLE, Harper’s BAZAAR and Cosmopolitan, are joining forces to launch the No Gender Selective Tax campaign and demand the removal of GST on tampons once and for all.

Let’s be clear, this isn’t just about women, it’s about equality and fairness. It’s not about taking a political position in favour of one side or another because all political parties at some point in the past have supported removing the GST from tampons. Now is the time for Liberal, Labor and the minor parties to come together and do the right thing.

If you agree, sign the petition and make your voice heard. Sign it for yourself, your sisters, your daughters, your friends, your future female family members. And share it too. Every single name will send a clear message that removing the GST on tampons is another step towards gender equality.

After all, getting your period shouldn’t be considered a luxury. And you shouldn’t be taxed because of it.

But what exactly is the tampon tax? And if it really is so bad, why was it developed in the first place – and why are we still paying it?

What is the tampon tax in Australia?

The tampon tax is a part of the national Goods and Services Tax in Australia. GST is a value added tax of 10% on most goods and services sales, with some exceptions for certain goods, healthcare and housing items.

One group of products that is definitely not an exception is female sanitary products. So for every product bought, females pay 10% on top of the already agreed price by the tampon company.

This extra money, $30 million each year to be exact, is then received by the government in form of GST.

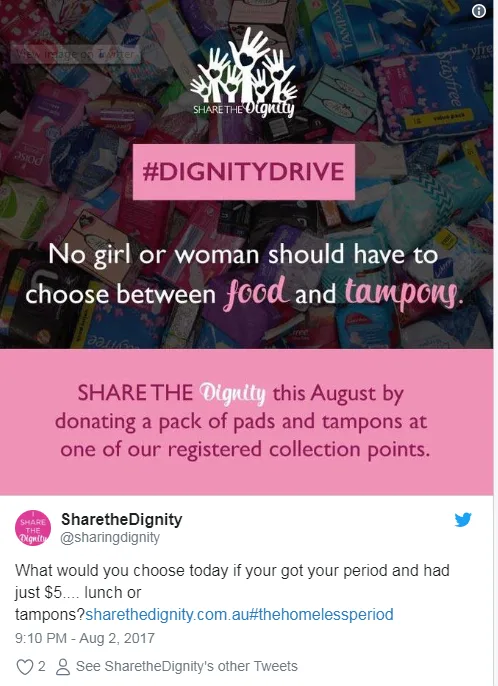

Share the Dignity is a charity that donates tampons and pads to women in need who simply can’t afford the “luxury” items.

Crazily enough, incontinence pads, sunscreen, nicotine patches, condoms and even Viagra are not taxed.

When did the tampon tax come into play?

The GST laws were written in 1999, commencing on July 1, 2000, and was introduced by the Howard Government. This was during John Howard‘s second ministry when only 2 out of the 20 Cabinet ministers were women.

In 2015, Treasurer Joe Hockey looked at whether GST should be removed from tampons and other women’s sanitary items but was shut down by the government.

In March this year, former Prime Minister, Tony Abbott, told 2GB “My distinguished treasurer was wrong then, and Tanya Plibersek is wrong now.”

“Look, once you start having these sorts of exemptions, where does it end? Where does it end?”

“We have to broaden the tax base, not start carving out politically correct exceptions.”

As deputy Labor leader, Tanya Plibersek, said: “Only a bunch of blokes sitting around a table would come to the conclusion that sanitary pads are anything other than an essential good.”

Tanya Plibersek and the Labor party have promised to axe the tax if elected.

Even though there have obviously been women in parliament since then, politicians like Pauline Hanson act as a buffer to any movement in this area. The One Nation senator says scrapping the “tampon tax” is not a national priority and won’t save women much money anyway.

“You’ve got just over 12 million women in Australia – that averages out to $2.46 per woman,” she told the Seven Network.

“Now, I know they all don’t need tampons but the fact is we’re talking about a minuscule amount.”

Here at Now To Love, we did a bit of math checking for Senator Hanson and discovered some similar yet differing results. The Australian Bureau of Statistics says that children aged 0-14 make up 18.8% of population. So on average girls aged 0-14 will make up 9.4% of the population, which is roughly 2.3 million. Similarly, people over 65 make up 15.3% and so women over 65 make up 7.65% of the population, which is 1.84 million.

There are roughly 12 million women in Australia and if you minus the above ladies who on average will not be needing the sanitary products there are roughly 8 million females in Australia who rely on these products.

Therefore if Australian women spend $300 million a year on sanitary products, $30 million in GST, that equates to $37.50 for every women per year, and $3.75 in tax. Even though, $4 does not seem like much. It is still $4 that our brothers, fathers, boyfriends and every single man do not have to pay on top of the $40 that they also do not have to pay. AND when you think about it in terms of the 15.3% gender pay gap in Australia – women really cannot afford to lose any more money than they have to.

What does the tampon tax mean for women across the country?

Essentially, this means that women across Australia are being forced to pay an extra 10% of the cost of their sanitary products as their government considers them to be “luxury” items.

Shadow Assistant Treasurer, Andrew Leigh, estimated in the Sydney Morning Herald that the decision to cut the tax would save the typical woman around $1000 over a lifetime. That’s $1000 that could be put towards saving for a car, house, paying back HECs or even simply just going out for a meal like their male counterparts.

Where is the tampon tax/conversation now?

Earlier this year the Shadow Minister for Health and Medicare, Catherine King, announced a Labor policy to scrap the 10% tax on female sanitary products if Labor was to be elected. The policy suggested that to offset the loss of revenue to the states from GST on sanitary items, GST will be applied consistently to 12 natural therapies that are sometimes GST free, such as herbalism and naturopathy.

The Foreign Affairs Minister, Julie Bishop, said the government already had the policy in place, but it was the states and territories – which must all agree to changes to the GST – that had stopped the change.

“The point is this: any change to the GST must be agreed by each state and territory government. And there is no agreement for the states and territories on this issue,” she told Channel Nine.

So even though the Senate passed the Greens’ bill to remove the tax, without putting it to a formal vote, in June this year, the bill is unlikely to pass in the House of Reps because the Coalition does not and will not support the change without the agreement of the states and territories.

Let’s hope that the states and territories can come to an agreement soon and end this tax once and for all.

Ever since the introduction of GST, women have been paying tax on tampons. Now Australia’s leading magazine brands including The Australian Women’s Weekly, Woman’s Day and Good Health have united behind the push to end what is essentially a tax on being a woman. Sign the petition below if you agree the Gender Selective Tax should be removed.

And share it too. Every single name will send a clear message that removing the GST on tampons is another step towards gender equality. After all, getting your period shouldn’t be considered a luxury. And you shouldn’t be taxed because of it.